From $1M to $1.1B: Boldstart Ventures Launches $250M Fund VII to Back Inception-Stage Founders Building the Autonomous Enterprise

Boldstart Ventures, the inception fund for technical founders building the autonomous enterprise, today announced the close of Fund VII, a $250 million vehicle dedicated to backing bold technical teams from the very first commit.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250708927572/en/

What began in 2010 as a $1 million proof-of-concept, before “pre-seed” was even a term, has grown into a platform with over $1.1 billion in assets under management. That growth hasn’t changed the strategy. Fund VII was significantly oversubscribed, but Boldstart chose to hold firm at $250 million to stay true to its model: high-conviction, hands-on investing at inception and nothing else.

“When others wait for signals, we bet on conviction,” said Ed Sim, Founder and General Partner. “Fund VII is our biggest commitment yet to the builders reimagining the operating system of the enterprise, where software, agents, and machines plan and act on our behalf. Staying at $250M lets us stay focused, stay early, and keep showing up for founders before the rest of the world believes.”

Fund VII will write initial checks from $500K to $15M, with the ability to support breakout growth through Boldstart’s existing $175M Opportunities III fund.

Video: https://www.youtube.com/watch?v=yQmLG9dOcUU

Backing Myth-Makers from Day Zero

“Inception is about far more than capital, it’s about compound leverage,” said Eliot Durbin, General Partner. “For 15 years, we’ve worked side by side with technical founders to help shape the earliest story, unlock first customers, and architect the conditions for breakout. That’s where Boldstart operates best, before the noise, before the signal.”

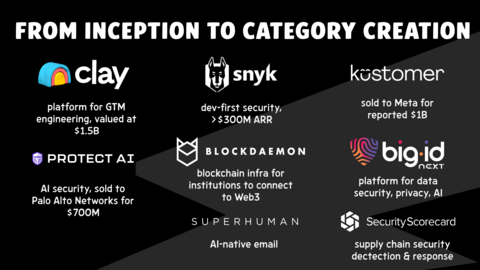

Standout inception-stage investments from first commit to category leader include:

- Snyk – creators of developer first security, now AI security leader, last valued at $7.4B

- Protect AI – AI security leader acquired by Palo Alto Networks for over $700M

- Clay – creators of GTM engineering valued at $3.1B

- Kustomer – reimagining customer support, sold to Meta for reported $1B

- CrewAI – Multi-agent platform powering 60M+ agent runs/month

- Spectro Cloud – leading enterprise Kubernetes platform, valued at $750M

- Hypernative – Real-time risk intelligence for crypto and traditional finance

Building the OS for the Autonomous Enterprise

Fund VII is focused on the core primitives powering a generational rewrite of the enterprise; one where software, agents, and machines operate at machine scale, continuously reasoning, learning, and acting.

It’ll invest across the stack:

- AI-native infrastructure

- Secure identity and permissionless coordination

- Agents driving autonomous execution, going beyond assistive tools to full-scale operation

- Semantic interfaces and robotic execution layers

- Programmable money, smart contracts, and crypto-native automation

These aren’t just new tools. They represent a full-stack shift from human-in-the-loop to machine-in-the-loop. The autonomous enterprise won’t be retrofitted from SaaS; it will be rebuilt from scratch.

The autonomous enterprise will require entirely new business models, robotic execution layers, and AI-native workflows built without a traditional back office. Crypto and smart contracts will unlock programmable money and permissionless automation, enabling trustless coordination across systems at scale. Systems will run at machine scale, continuously learning, reasoning, and operating in real time.

We have already partnered with teams like Generalist AI and several stealth startups tackling massive real-world problems and rethinking how intelligence moves through the enterprise stack.

An early preview of model capabilities | Generalist

“This isn’t about optimizing yesterday’s stack,” added Sim. “It’s about building the operating system for the intelligent enterprise; from scratch, wired for autonomy, and secured from day one.”

For more information, visit: boldstart.vc | inception.vc

Watch the Fund VII announcement video: YouTube Link

About boldstart ventures

boldstart ventures is the inception fund for technical founders building the operating system of the autonomous enterprise. We invest before the product, pitch deck, or company exists, backing bold ideas that feel more like myth than market. Since 2010, we’ve partnered with 130+ founding teams, helping turn raw conviction into breakout momentum. Our portfolio includes category-defining companies like Snyk, BigID, Protect AI (sold to Palo Alto Networks >$700M, Clay, Kustomer (sold to Meta $1B), Blockdaemon, and CrewAI.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250708927572/en/

Distribution channels:

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release